Export Leads From Sales Navigator

Create a clean B2B email list from LinkedIn Sales Navigator in just one click with the Evaboot Chrome Extension.

Export Leads From Sales Navigator

Create a clean B2B email list from LinkedIn Sales Navigator in just one click with the Evaboot Chrome Extension.

Contents

Lead generation for insurance is the engine behind every successful insurance business.

Whether you’re selling life, auto, health, or commercial coverage, your biggest challenge is always the same: how to find qualified insurance leads without wasting hours on cold calls or overpriced lists.

But finding leads doesn’t have to feel like a guessing game.

Today, top-performing insurance agents use a mix of targeted outreach, content-driven marketing, and smart tools to consistently fill their pipelines with high-quality prospects.

In this guide, we’ll break down exactly how to find insurance leads that convert — using lead generation strategies built for 2026, not 2010.

Here’s the breakdown:

Whether you’re an independent broker or part of a national agency, this article will help you build a repeatable system for finding and closing more deals.

Let’s dive in.

These 8 proven strategies will show you exactly how to find leads for insurance sales:

Cold outreach remains one of the most overlooked yet effective ways to generate high-quality insurance leads. Especially when targeting business owners, HR professionals, or individuals making big financial decisions.

LinkedIn is a goldmine for this.

It allows you to identify decision-makers and high-income prospects based on job title, industry, location, and company size — making it perfect for agents selling life, health, commercial, or key person insurance.

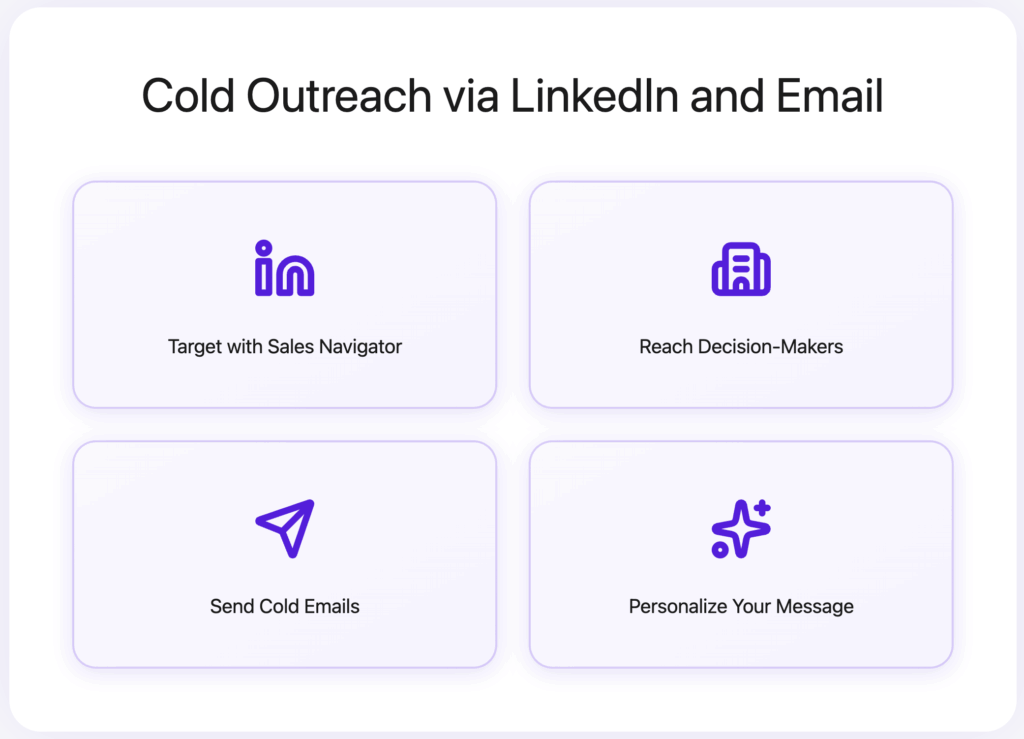

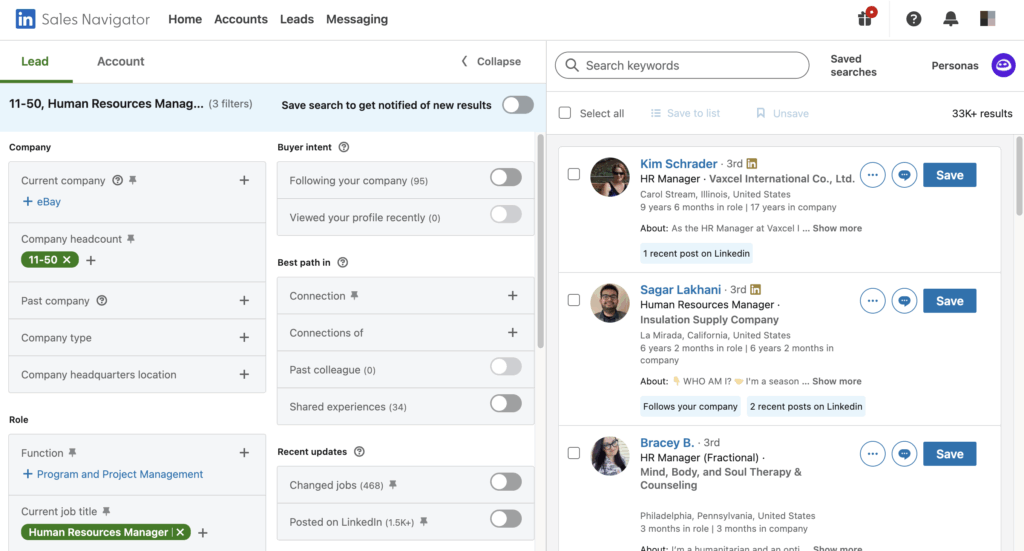

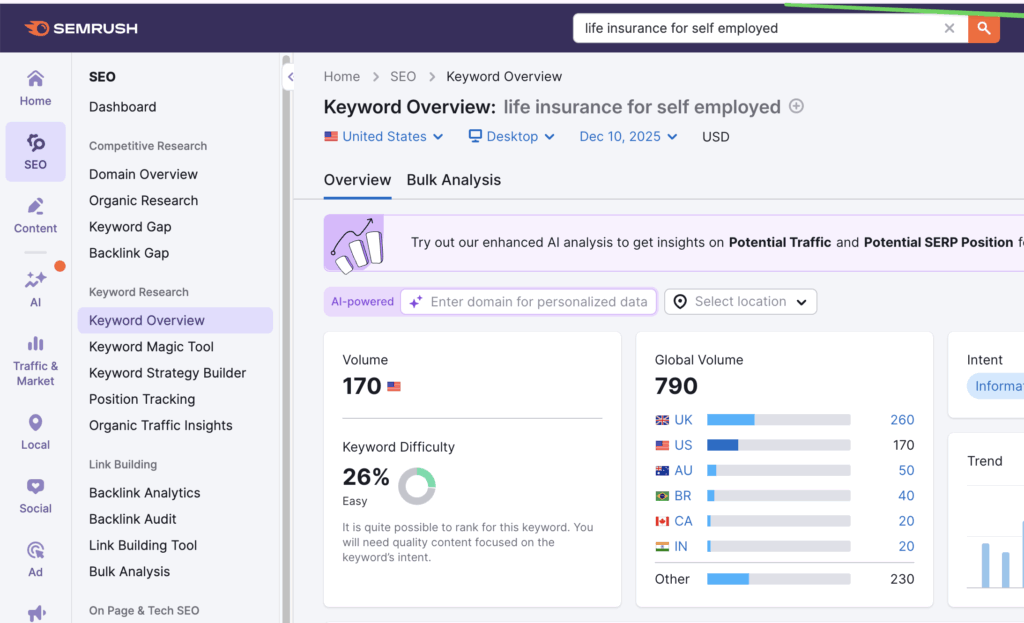

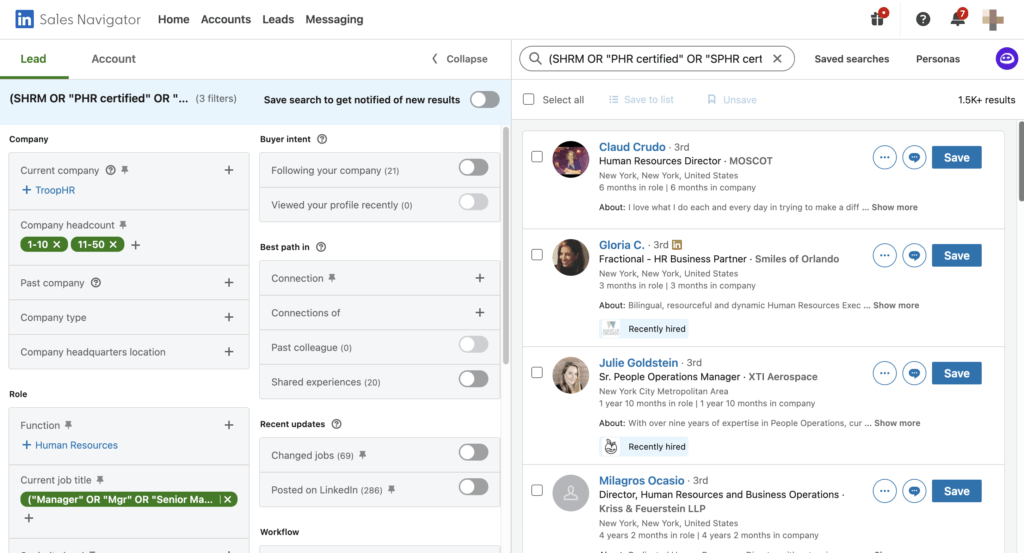

If you’re ready to invest some money in a powerful tool, you can even create hyper-targeted lead lists on Sales Navigator, based on filters like location, job title or industry.

For example, you can find:

Once identified, these leads can be reached with personalized cold emails or LinkedIn messages that speak directly to their needs.

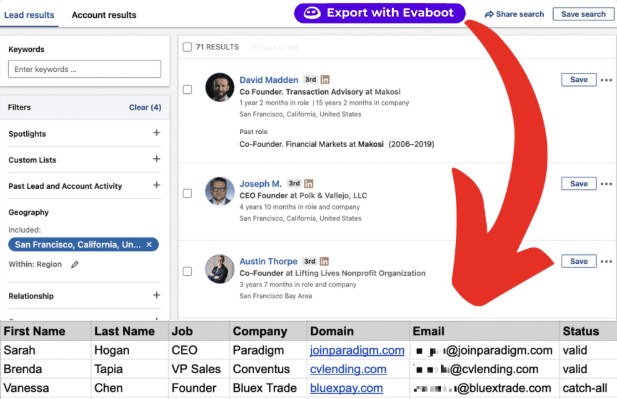

And instead of manually copying leads from LinkedIn, tools like Evaboot help you export LinkedIn Sales Navigator lead lists in one click — removing irrelevant profiles and exporting qualified contacts instantly.

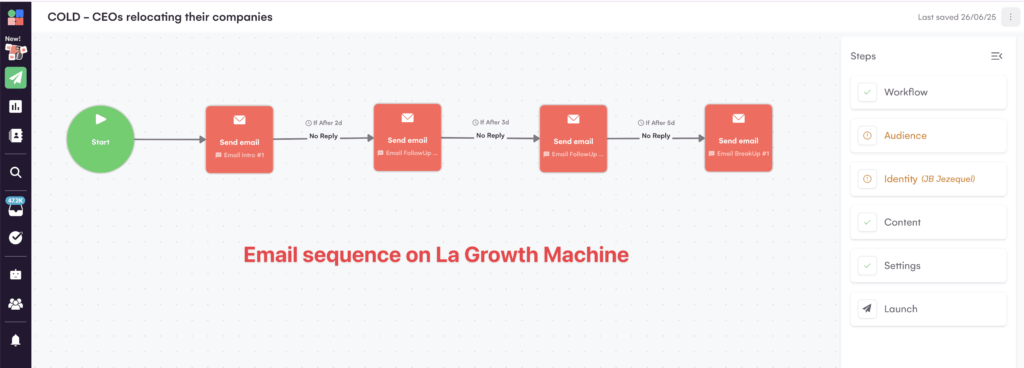

Then, plug those leads into a cold email software like Instantly or Lemlist, and launch personalized sequences that highlight how your coverage solves a specific risk or business need.

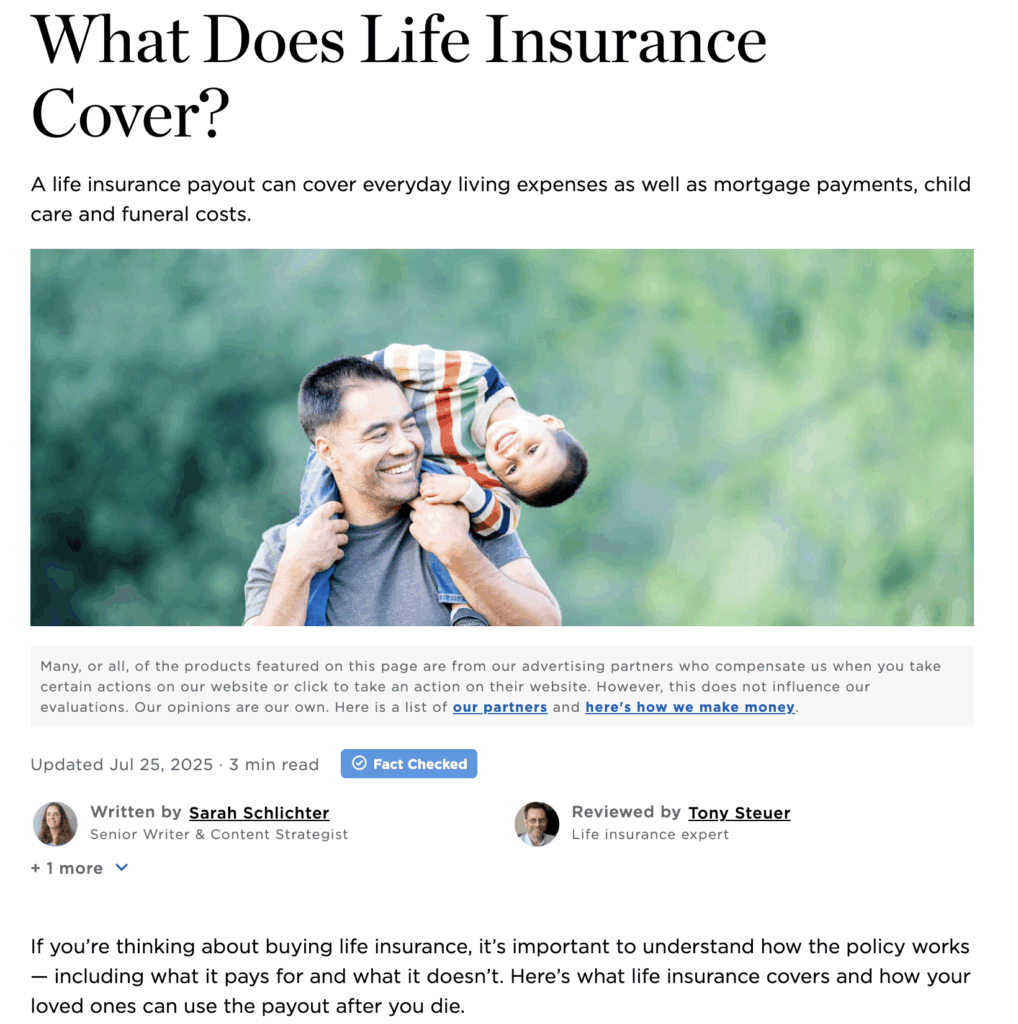

Content marketing is a cost-effective way to attract qualified insurance leads — by educating prospects instead of chasing them.

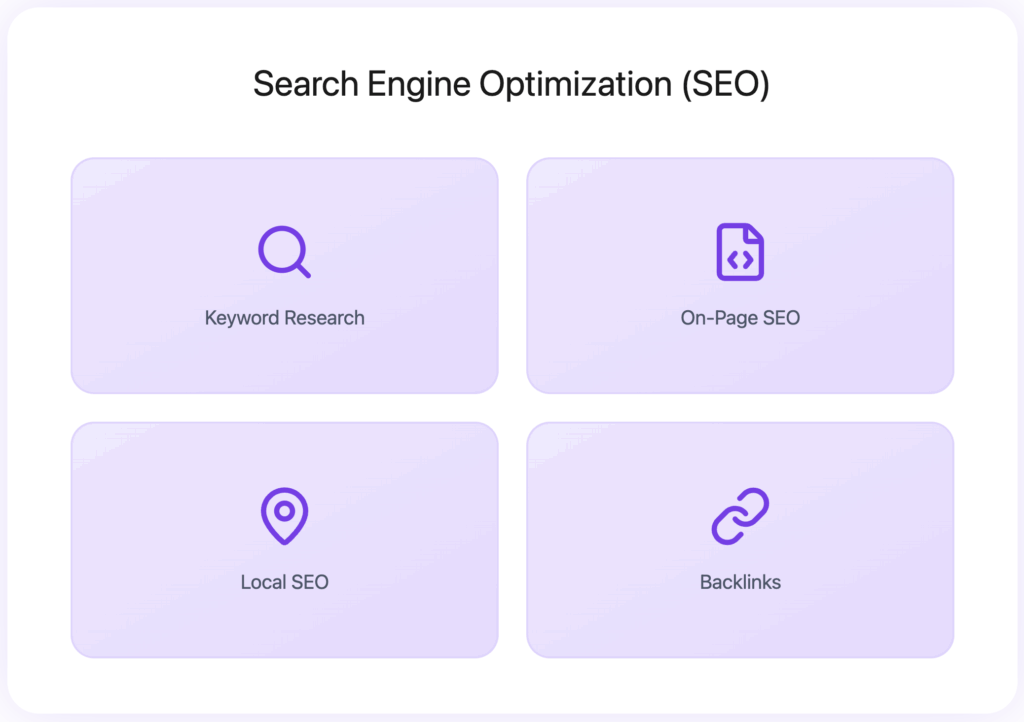

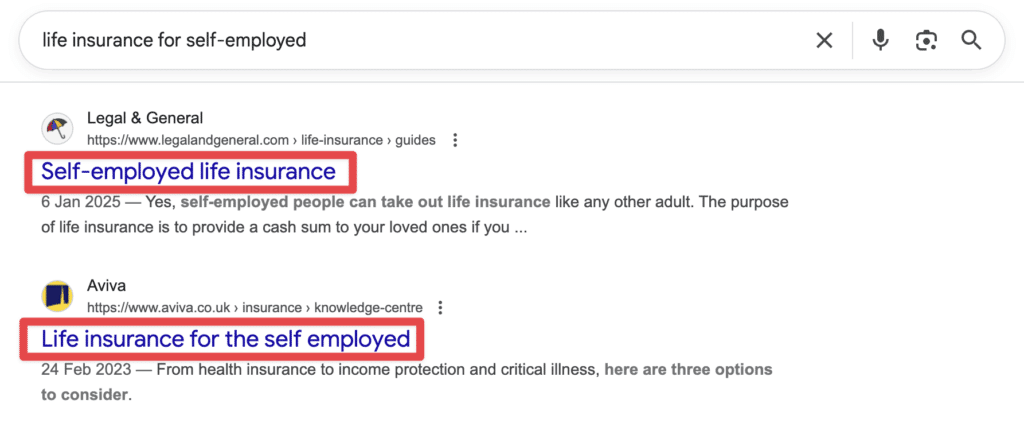

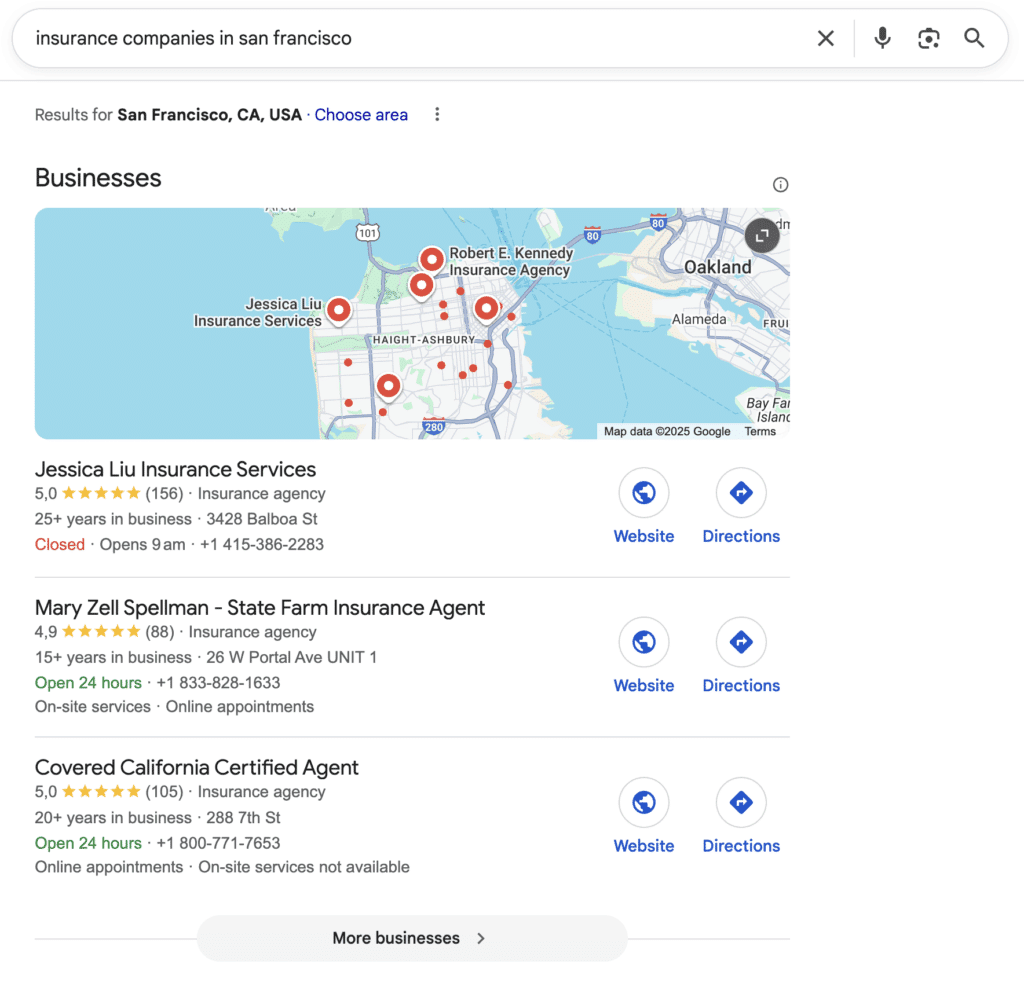

If you want insurance leads to find you, Search Engine Optimization (SEO) is a must.

Social media isn’t just for brand awareness. It’s a powerful way to attract and convert insurance leads when you show up consistently with value.

Once someone enters your funnel, email marketing is the best way to stay top-of-mind — and convert leads into paying clients over time.

When it comes to trust, nothing beats a personal referral — it’s one of the highest-converting lead sources in insurance.

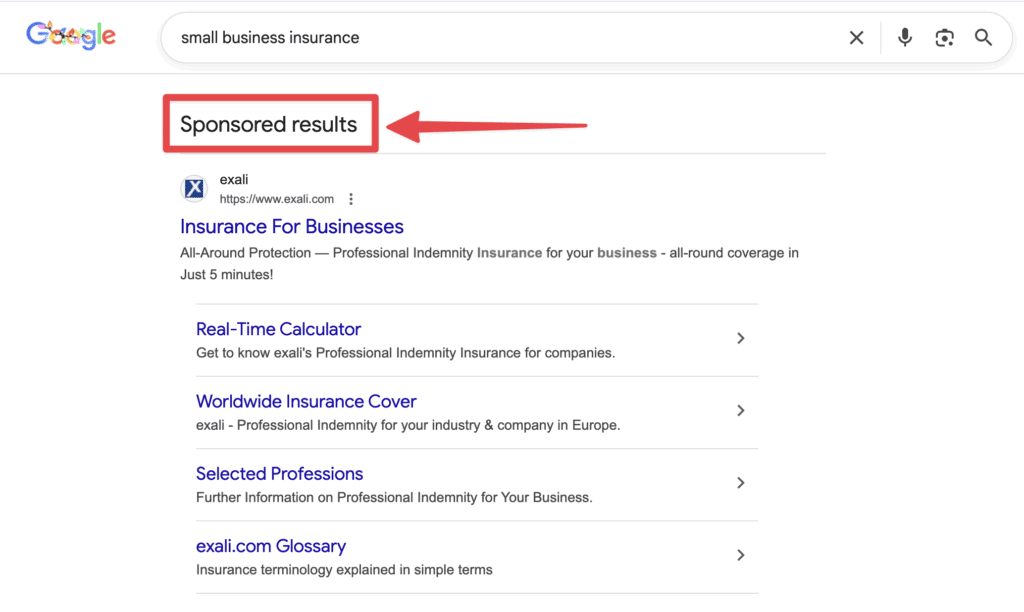

Pay-per-click (PPC) advertising is one of the fastest ways to get your insurance offers in front of the right people — exactly when they’re searching.

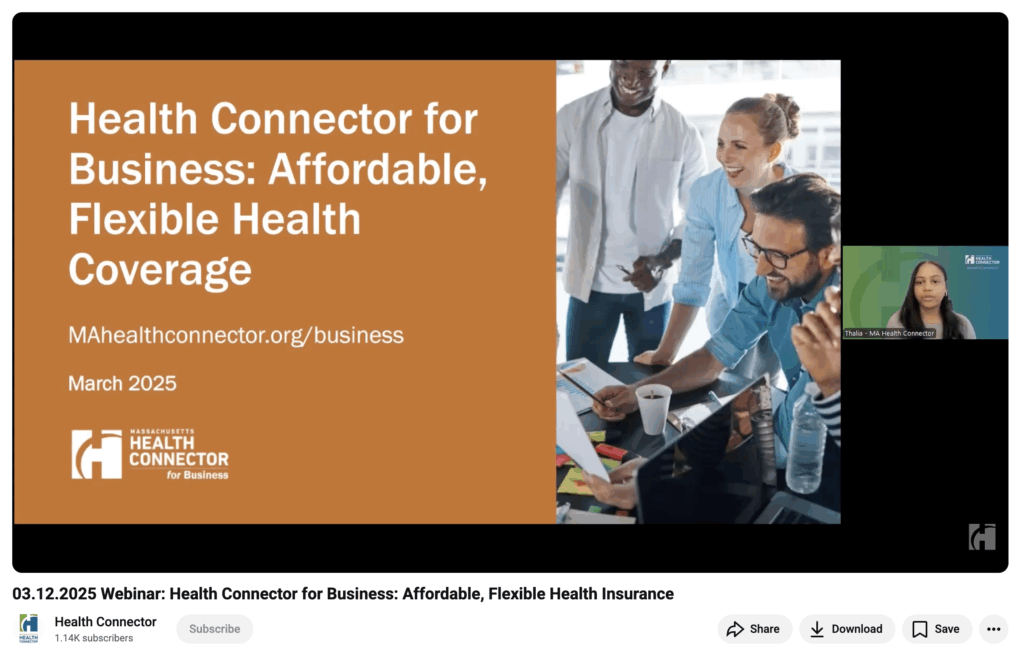

Webinars and in-person workshops are a powerful way to educate, build trust, and generate leads — all at once.

Technology doesn’t just save time, it helps you find better leads, faster.

These tools will streamline your outreach, automate your follow-up, and show you what’s actually working:

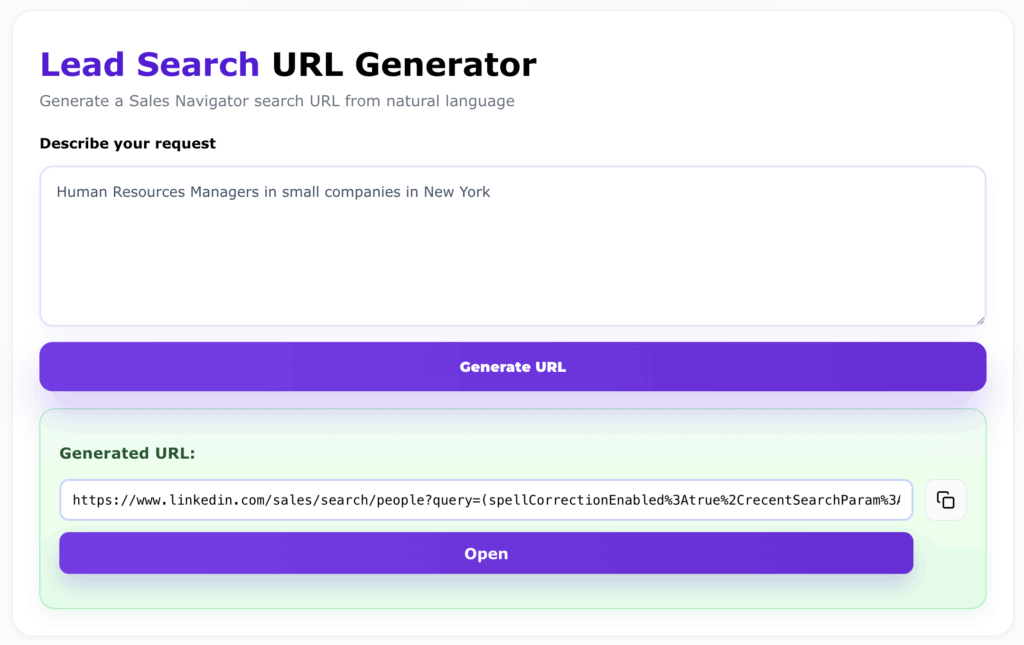

Want to target high-value insurance prospects on LinkedIn without spending hours on filters?

Evaboot’s Sales Navigator URL Generator uses AI to turn a plain-English description into a ready-to-use Sales Navigator search link.

For example, try:

“Human Resources Managers in small companies in New York”

➔ Click here to see the search in action

Once the leads are surfaced, you can export them with the Evaboot Chrome extension and get a CSV with clean data and verified professional emails.

This tool takes you from “I need leads” to “Here’s my list” in seconds — no spreadsheets, no scraping, no guesswork.

Your CRM is your control center: it helps you stay organized, consistent, and responsive, even when you’re handling dozens of clients at once.

Whether you’re solo or part of a growing agency, a CRM keeps you from losing hot leads to poor timing.

Best tools:

Posting manually every day? That’s not sustainable. Use tools to help you stay visible without the daily grind.

This is key if you’re using organic content or running ads — especially when balancing multiple client types or campaigns.

Best tools:

Insurance leads often need time before making a decision. A well-timed email sequence keeps you top-of-mind without being pushy.

Done right, email helps you turn cold leads into warm conversations — automatically.

Best tools:

Your website is your digital storefront — but only if you know how people are using it.

Use this data to improve SEO, fix drop-off points, and boost conversions.

Best tools:

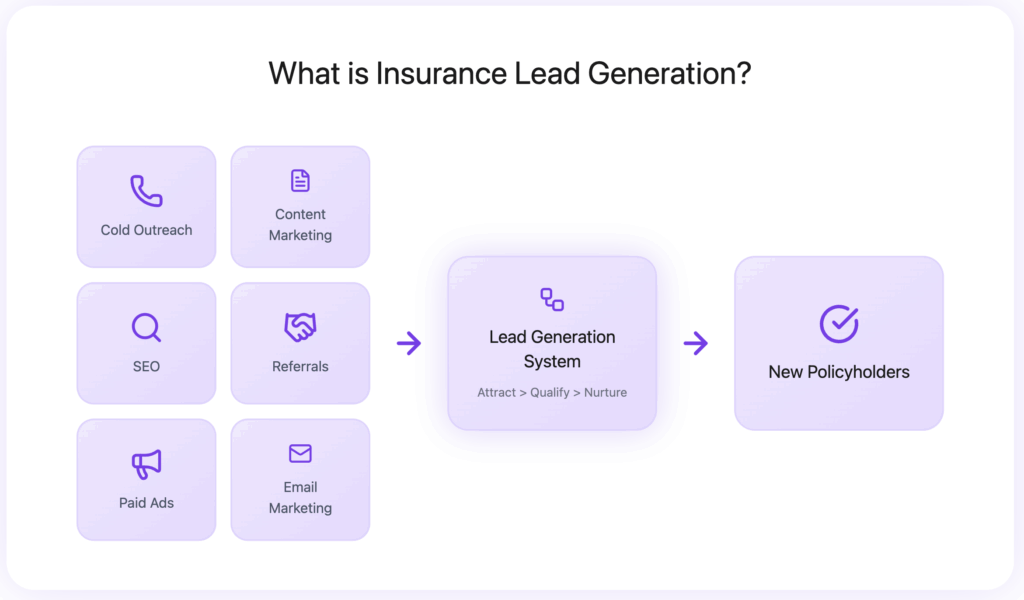

Insurance lead generation is the process of finding and attracting people or businesses who are interested in buying insurance, and turning them into potential clients.

It includes everything from outreach and advertising to content marketing, referrals, and SEO: all with one goal: fill your pipeline with qualified leads who are likely to become policyholders.

Done right, lead generation ensures you’re never stuck wondering where your next client is coming from — because you’ve built a system that brings them to you.

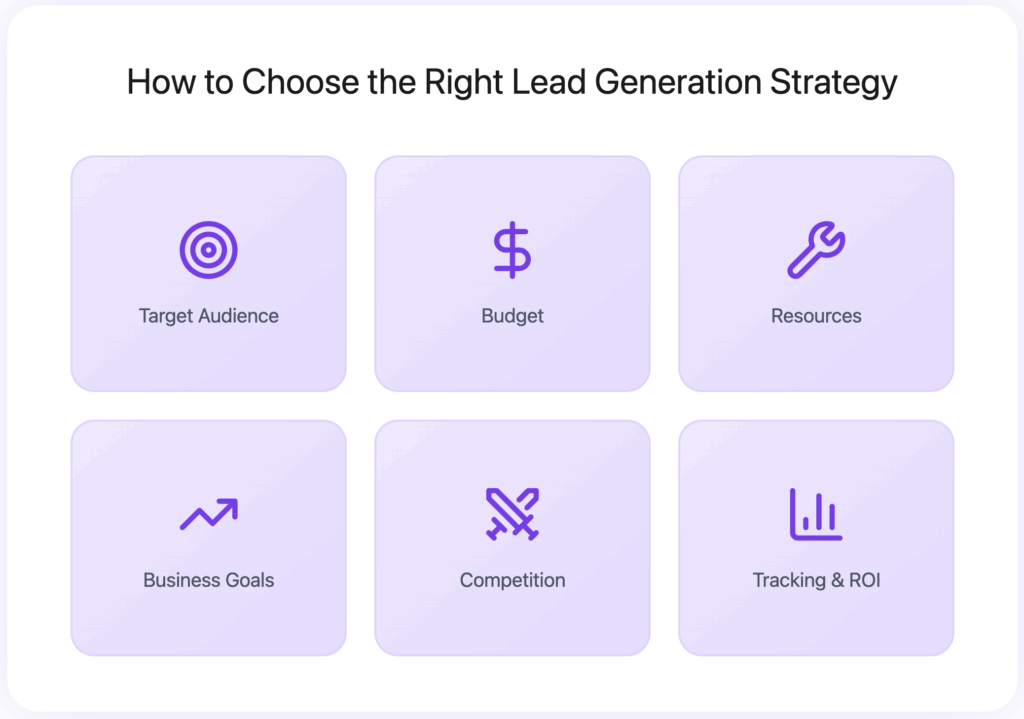

Not every strategy works for every agency. Use these filters to choose what fits your goals and resources best.

Start simple. Pick 1–2 strategies, test them, and double down on what works.

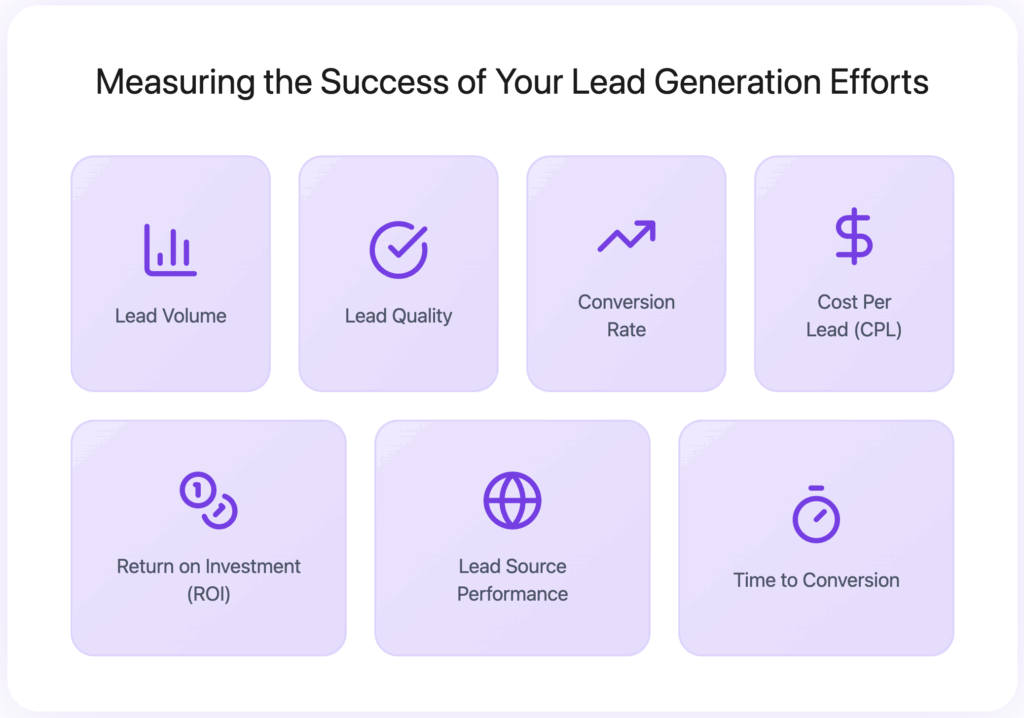

Tracking performance isn’t optional: it’s the only way to know what’s working and where to improve.

Review these metrics regularly, double down on what works, and cut what doesn’t. That’s how your lead gen gets stronger every month.

Effective insurance lead generation isn’t about chasing random leads: it’s about building a system that brings the right ones to you.

When you apply the right mix of strategies, use tools that save you time, and track what actually moves the needle, you create a process that scales.

Whether you’re focused on life, health, auto, or commercial insurance, the formula stays the same: start conversations, follow up consistently, and improve what works.

A lead in insurance is a prospective client who has shown some level of interest in an insurance product or service.

This interest could be expressed through filling out a form, making an inquiry, visiting your website, or engaging with your marketing content.

Yes, several methods offer free insurance leads:

• Referrals: Asking current satisfied clients for introductions.

• Networking: Attending local business events and building relationships.

• Content Marketing: Creating valuable blog posts, videos, or guides that attract organic traffic.

• Social Media Engagement: Actively participating in relevant online groups and conversations.

• Local SEO: Optimizing your Google My Business profile for local searches.

These methods require an investment of time and effort rather than direct financial cost.

There isn’t one universal “best” way to generate insurance leads, as effectiveness depends on your specific business, target audience, and resources.

However, a multi-channel approach often yields the best results.

Combining strategies like content marketing, SEO, referrals, and targeted online advertising allows you to reach a broader audience and engage prospects at different stages of their buying journey.

Top insurance agents typically get leads through a combination of:

• Strong Referral Networks: Cultivating relationships with existing clients and strategic partners.

• Robust Online Presence: Using SEO, content marketing, and active social media profiles.

• Personalized Outreach: Employing direct mail, email, and LinkedIn for targeted engagement.

• Community Involvement: Participating in local events and building a strong local reputation.

• Data-Driven Decision Making: Analyzing lead sources and conversion rates to optimize their efforts.

They consistently focus on providing value and building trust.

No, buying insurance leads isn’t worth it for most agents.

While it may seem like a fast way to fill your pipeline, purchased leads are often low quality, overpriced, and shared with multiple agents.

Most of the time, these leads aren’t expecting your call, haven’t shown real intent, and rarely convert at a profitable rate.

Instead of paying for cold lists, invest in building your own lead generation system.